Many Canadian seniors may receive around $2400 in total federal retirement income for DJanuary 2026 when they combine payments from Old Age Security, Guaranteed Income Supplement & Canada Pension Plan. This amount is most likely for low-income seniors who qualify for the maximum Guaranteed Income Supplement. This is not a new $2,400 bonus from the Canada Revenue Agency. Instead it represents the combined total of existing indexed pension and income support programs that are paid by direct deposit shortly before Christmas.

What the “$2,400 Direct Deposit” Actually Refers To

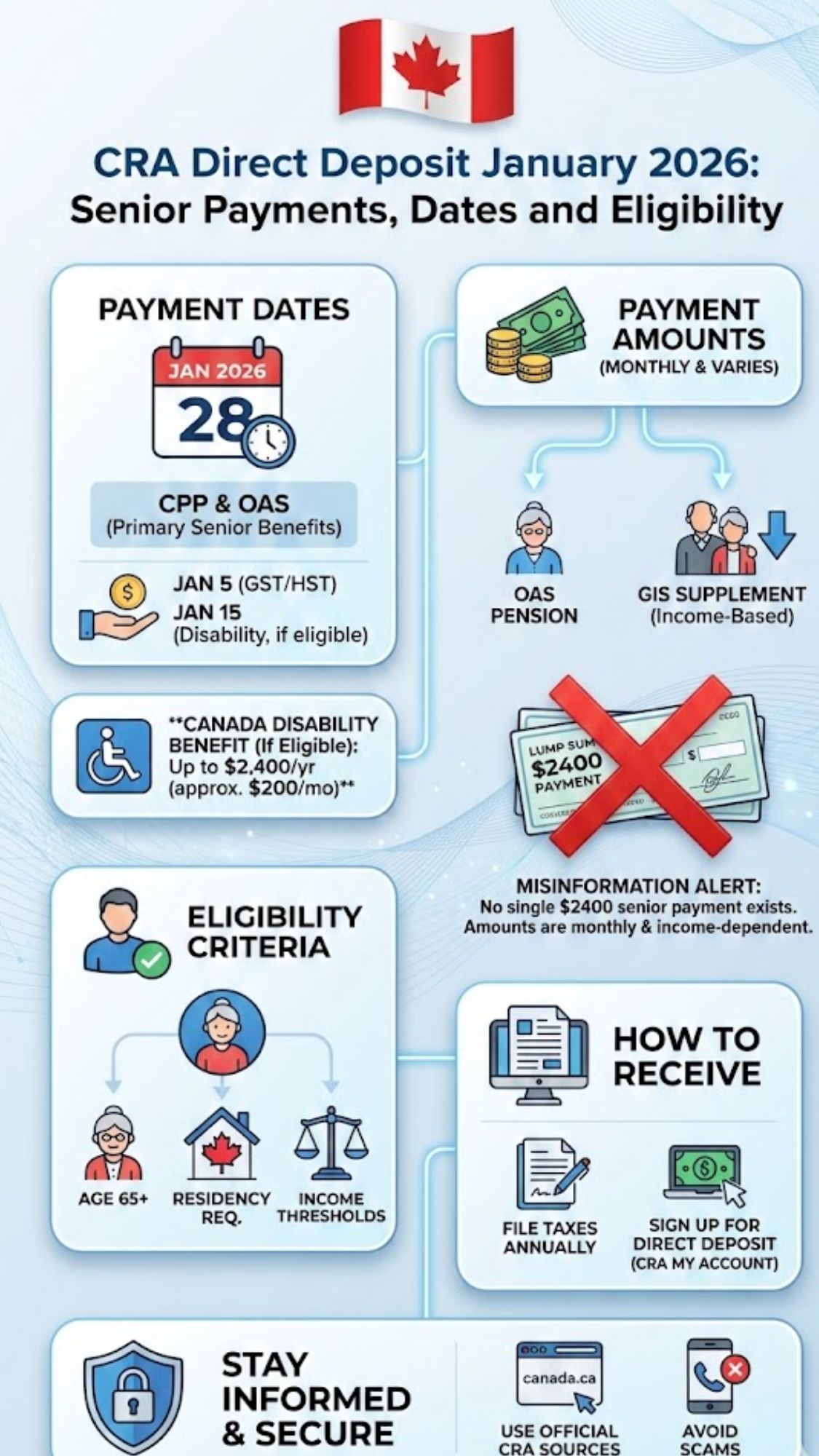

The widely shared figure of $2,400 does not point to a new bonus or special one-time payment. Instead, it reflects how regular OAS, GIS, and CPP benefits can combine for some seniors during January 2026. When these federal pensions align in the same month, eligible recipients may see a total deposit that approaches or exceeds this amount. Seniors with stronger CPP contribution histories and those qualifying for maximum GIS due to low income are the most likely to reach this level. All three benefits follow established payment schedules and are usually delivered by direct deposit.

January 2026 OAS and CPP Payment Schedule

Official federal calendars confirm that both OAS and CPP payments are scheduled for 22 January 2026. This earlier-than-usual timing helps avoid delays caused by Christmas holidays and year-end banking closures. Historical payment summaries show that late-year deposits are often adjusted to ensure funds arrive before holidays. CPP follows the same pattern, with banks and financial planners listing 22 December as the December retirement payment date for direct deposit recipients.

How OAS and GIS Rates Contribute to the $2,400 Total

Old Age Security is indexed quarterly, with October–December 2026 payments reflecting the latest inflation adjustment. Maximum OAS amounts are estimated in the mid-$700 range for seniors aged 65–74, while those aged 75 and older receive just over $800 per month due to the permanent 10% increase. The Guaranteed Income Supplement can add more than $1,000 monthly for low-income single seniors. When full OAS and maximum GIS are combined, monthly totals can exceed $1,800 even before CPP is added.

The Role of CPP in January 2026 Payments

Canada Pension Plan benefits vary widely because they depend on lifetime contributions, pensionable earnings, and the age at which payments begin. For January 2026, CPP is also scheduled for 22 January 2026, aligning with OAS for easier budgeting. Seniors with strong contribution records may receive several hundred dollars or more each month, while even modest CPP amounts can significantly increase the total deposit when layered onto OAS and GIS. This combination explains how many seniors can reach the $2,000–$2,400 range.

Who Can Reach a Combined $2,400 Payment

Reaching a combined total near $2,400 generally requires three factors: full or near-full OAS, eligibility for a substantial GIS top-up, and a moderate CPP pension. OAS eligibility is based on age, legal status, and years of residence in Canada, with 40 years typically needed for a full pension. GIS depends on receiving OAS and having income below annual thresholds. CPP eligibility is tied to past employment or self-employment contributions, with payment size shaped by earnings history.

Key Income and Residency Requirements

Both OAS and GIS require recipients to meet residency conditions, including minimum years lived in Canada after age 18. GIS is usually paid only to those residing in Canada and stops after extended absences. Income thresholds differ for single seniors and couples, and amounts adjust depending on whether a spouse also receives OAS or GIS. Because of these rules, a low-income single senior may receive a higher GIS amount than each partner in a couple with similar total income.

How Direct Deposit Works in January 2026

Most seniors receive OAS, GIS, and CPP through direct deposit, which is the fastest and most reliable option. Payment rules state that when dates fall on holidays or weekends, deposits are made on the prior business day. For January 2026, the scheduled Monday payment avoids holiday disruptions. Cheques remain available but may arrive later, especially during winter conditions. Keeping banking details updated helps ensure all benefits arrive on time when multiple payments are issued together.

Understanding Combined January 2026 Payment Scenarios

Illustrative examples based on published January 2026 rates show how combining OAS, GIS, and CPP can approach or exceed $2,400 in December. Not every senior will reach this amount, but low-income single seniors aged 75 and over with moderate CPP entitlements are the most likely. Couples may receive higher household totals, although per-person GIS amounts are often lower than for singles. These scenarios highlight how regular benefits, rather than special bonuses, create larger December deposits.

| Scenario (January 2026) | OAS Monthly Amount | GIS Monthly Amount | CPP Monthly Amount | Estimated Combined Total |

|---|---|---|---|---|

| Single senior aged 65–74 with low income | Approx. $735 | Approx. $1,060 | Approx. $495 | About $2,290 |

| Single senior aged 75+ with very low income | Approx. $810 | Approx. $1,055 | Approx. $545 | About $2,410 |

| Married couple where both qualify for OAS & GIS | Approx. $735 each | Approx. $665 each | Approx. $395 each | Roughly $2,800 per couple |

| Senior with higher CPP and no GIS eligibility | Approx. $740 | $0 (income exceeds limit) | Approx. $1,600 | About $2,340 |

| Senior aged 75+ living abroad with partial OAS | Approx. $500 (partial) | $0 (outside Canada) | Approx. $1,200 | About $1,700 |

Indexation and Policy Context for 2025–2026

OAS is reviewed quarterly using the Consumer Price Index, with October–December 2026 rates already reflecting the latest adjustment. CPP benefits are indexed annually in January, meaning the January 2026 amount includes the January 2026 increase but not any 2026 change. Official guidance confirms there is no separate $2,400 CRA payment planned for January 2026. The focus remains on timely delivery of existing pension benefits under established rules.

Steps Seniors Can Take to Maximise December Income

To receive full entitlements, seniors should ensure their 2024 tax return has been filed, as GIS and other income-tested benefits rely on assessed income. Those with low income who are not receiving GIS may wish to review eligibility and apply through Service Canada. Checking CPP contribution records and keeping direct deposit information current can also prevent delays. While January 2026 amounts are fixed for current recipients, future retirees can influence CPP levels by choosing when to start benefits.

Common Payment Issues and How to Prevent Delays

Delays can occur if bank details are incorrect, accounts are closed, or addresses are outdated. Some seniors may see reduced GIS if income rises above thresholds due to work or withdrawals. If a payment does not appear shortly after the scheduled date, recipients should confirm the date, review online account messages, and then contact Service Canada or their bank if needed. Planning around the 22 January 2026 deposit helps seniors manage holiday expenses and year-end commitments.